How to Qualify for GTbank Quick Credit Loan

- Advertisement -

GTBank quick credit is right for both salary earners and self-employed entrepreneurs – Yes, for real! I know that a lot of people find it difficult to believe this simple truth but you need not worry. I will break every piece of the puzzle here for you, and you will see how to qualify for GTB quick credit in minutes. So, grab a drink and let’s see what this quick loan in Nigeria holds.

Table of Contents

What is GTBank Quick Credit?

The Quick Credit is a flexible loan service open to both salary earners and self-employed entrepreneurs who run an account with GTBank. It has been open since the third quarter of 2019. This loan service allows customers with a salary account to get up to N5 million credit. For those without a salary account, you can get up to N1 Million. This flexible loan service is accessible without any collateral and can be secured in minutes. Interestingly, you don’t have to go to the bank. In fact, no physical documentation is needed.

The Interest Rate Calculation for GTBank Quick Credit

If you qualify for this loan, it comes with an interest rate of 1.75% on a monthly basis. And the repayment is usually between 6 months and 12 months (1 Year). So, let’s do a bit of calculation here. If you choose to pay back in 6 months, you interest would be 1.75 X 6 = 10.5% interest. Which means, if you are given N1 million to pay back in 6 months, you will be required to pay a total of N105,000 as interest. In contrast, a 12 months repayment plan attracts 21% interest. But before you start to worry about the GTBank Quick Credit interest rate, it’s still 1.75% a month. So, if you get N1 million and are paying back in 6 months, its only N10,500 interest in a month.

Criteria to Qualify for GTB Quick Credit Loan

I hear a lot of people lamenting about how they have not been able to secure a loan using this service. Every quick loan in Nigeria has it’s own unique requirements. Many of people get a direction to open a salary account which makes them thing that it is only good for salary earners. NO! The truth is that many of us in Nigeria don’t know what is called credit history.

We also lack the understanding of how to keep a good credit history with banks. When it comes to getting loans from banks, your credit history is the language your bank understands. Not your project or you good intentions to repay in time. Chances are that even if you have bad manner and your character ain’t nothing to write home about, the bank will still give you a loan if you have a good credit history. So, let’s quickly talk about the criteria to qualify for this quick credit from GTBank one after the other.

- Have an Existing Account with GTBank

- Have a good credit history

- Preferably, use a current account to apply

- The employer factor

- Salary scale

- Monthly lodgement

Have an Existing Account with GTBank

Of course, GTBank has nothing to do with you if you don’t bank with them. Don’t mind the way I put that but it’s pretty simple. Another important thing is that if you are just going to open a fresh account, it may not work for instant loan. At least for now. You will have to run the account for some time – long enough to earn the bank’s trust.

Good Credit History

While your credit history is supposed to be drawn for your record of loan repayment, things get a little twisted here. Since you probably have not gotten any loan from the bank before, what they focus on is your cash inflow and outflow. That is, is the rate at which you receive money into your account frequent enough? If frequent, for how long have you maintained it? Good inflow rate gives your bank a green light when they think of lending your some money.

Use a Current Account

While the bank did not state that a current account is needed before non-salary accounts can get awarded, we have found that current accounts hold more credibility than an ordinary savings account. Also, applicants with current account stand a better chance of getting approved. We have asked applicants of the GTBank Quick Credit, and that is what the index shows.

The Employer Factor

If you are applying for this quick loan in Nigeria with a salary account, this is important. You must have worked for the same employer for at least 3 months. So, if you have been paid for up to six months, you can be double sure.

Salary Scale

Now we know that what different individuals earn is not the same. GTBank has also put this into consideration and landed a safety mark. To qualify for this quick loan in Nigeria, you must be earning at least N10,000 a month.

Monthly Lodgement

For self-employed citizens, you must have a consistent record of monthly lodgement of at least N20,000. That is, your savings or current account must be receiving an inflow of N20,000 minimum every month. This is one way to prove to the bank that you can meet their repayment conditions.

That’s pretty much all that you need to qualify. Now let’s talk about how to apply and win the loan offer.

How to Apply for GTBank Quick Credit in Nigeria

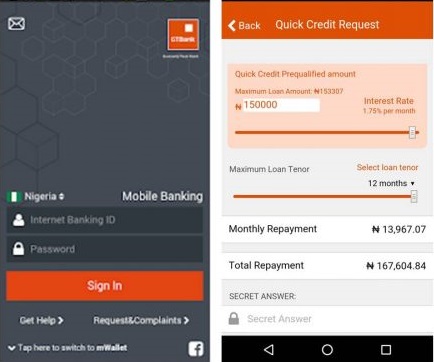

You can either use a USSD code, mobile banking application on your Android or iOS smartphone, or Online banking. If you are using the USSD code, you must use the phone number linked with the account you are using to apply. If you use any other phone number, you will be asked to open an account. This is because the system will not find any GTB account on the number used.

The USSD Code to press is *737*51*51#

For the mobile banking app, once you sign in, you will see the Quick Loans option on the left panel. There you can find your eligibility status and the maximum amount you can request.

Once you meet all the conditions above, you can be sure that your application will be successful. You can also check these terms and conditions of the bank for the flexible loan service.

Banking with FCMB? Chat with TEMI

Let us know in the comment section if you got approved

- Advertisement -